B2Gold Competitive Advantage

Share Capital(1)

| Total Shares Issued and Outstanding | 1,302,948,967 | |

| Directors and Management | 11,741,403 | |

| Stock Options | 27,907,854 | |

| Restricted Share Units | 3,322,373 | |

| Performance Share Units | 4,712,920 | |

| Total Shares Diluted | 1,338,892,114 | |

| Market Capitalization (Basic)(2) | $4,325,790,570 | |

| Market Capitalization (Diluted)(3) | $4,445,121,818 |

| (1) Approximate figures are as of February 23, 2024. | ||

| (2) Based on the shares currently issued x the closing price of B2Gold’s shares of Cdn$3.32 per share on February 22, 2024. | ||

| (3) Based on the diluted shares x the closing price of B2Gold shares of Cdn$3.32 per share on February 22, 2024. |

Management

|

Clive T. Johnson - President, Chief Executive Officer & Director

Clive Johnson has served as a Director and the President of B2Gold since December 2006 and Chief Executive Officer since March 2007. Click here for full bio

|

Mike Cinnamond - Senior Vice President, Finance & Chief Financial Officer

Mike Cinnamond has served as our Senior Vice President of Finance and Chief Financial Officer since April 1, 2014. Click here for full bio

|

William Lytle - Senior Vice President & Chief Operating Officer

As the Senior Vice President & Chief Operating Officer, Bill manages all mining and engineering operational activities from acquisitions through closure, and coordinates engineering teams for due diligence, acquisitions, engineering, construction, operations and closure. Bill has been a valued member of the senior executive team, ensuring B2Gold delivers on its business strategy with regards to operations as well as the Company's Sustainability, HSE, Supply Chain and IT functions that will continue to resort under his care together with Mine Engineering, Metallurgy, Maintenance and Projects. Click here for full bio

|

|

Randall Chatwin - Senior Vice President, Legal & Corporate Communications

Mr. Chatwin has more than 15 years’ experience in the mining industry and joins B2Gold from Goldcorp Inc.Click here for full bio

|

Victor King - Vice President, Exploration

Mr. King has more than 30 years of senior management experience in exploration, development and production in the gold mining industry. He joined B2Gold Corp at the end of 2013 following the acquisition of TSE-listed Volta Resources, where he was Chief Operating Officer from 2006 to 2013.Click here for full bio

|

Dennis Stansbury - Senior Vice President, Engineering & Project Evaluations

Dennis Stansbury has served as our Senior Vice President of Engineering and Project Evaluations (and prior to that our Senior Vice President of Development and Production) since March 2007. Click here for full bio

|

|

Eduard Bartz - Vice President, Taxation & External Reporting

Eduard Bartz has approximately 20 years of direct experience in the mining industry, joining Bema in April 1997. Click here for full bio

|

Andrew Brown - Vice President, Exploration

Andrew Brown has over 25 years of experience in the mining industry and joined B2Gold in 2012, and was appointed Chief Geologist, West Africa in 2014. He has held increasingly senior positions in B2Gold’s principal exploration programs, most recently as Exploration Manager, Africa. Click here for full bio

|

Ninette Krohnert - Vice President, Human Resources

Ninette Kröhnert joined B2Gold Namibia in 2013 as HR Manager, supporting the Otjikoto Mine construction and operational phases, and Fekola’s construction and operations as Global HR Manager. Click here for full bio

|

|

Michael McDonald - Vice President, Investor Relations & Corporate Development

Michael McDonald has more than 15 years of experience in capital markets and joins B2Gold from Gold Standard Ventures where he served as Vice President, Corporate Development & Investor Relations from 2021. Click here for full bio

|

Peter D. Montano - Vice President, Projects

Mr. Montano started his career as a civil and geotechnical engineer, specialising in civil infrastructure and mining projects throughout the Americas, before adding mining engineering to his portfolio. Collectively, he has over 15 years of global experience in the mining industry that encompasses geotechnical engineering, mine construction and operation, open-pit design and planning, financial modelling and project optimization. Click here for full bio

|

Dan Moore - Vice President, Operations

Daniel Moore has over 30 years’ gold mining experience in operations, project management, and engineering roles. He has been with B2Gold since 2017 when he joined one of its subsidiaries, Phil. Click here for full bio

|

|

John Rajala - Vice President, Metallurgy

ohn Rajala has more than 30 years of experience in precious metals plant operations, management, engineering and process development. Click here for full bio

|

Neil Reeder - Vice President, Government Relations

Neil Reeder joins B2Gold following a distinguished government career of over 35 years with Global Affairs Canada. Click here for full bio

|

Dana Rogers - Vice President, Finance

Dana Rogers was appointed Vice President of Finance in October 2018. Ms. Rogers joined B2Gold in January 2014 as Corporate Controller and was promoted to Director of Finance in 2017. Click here for full bio

|

Directors

|

Clive T. Johnson - President & Chief Executive Officer & Director

Clive Johnson has served as a Director and the President of B2Gold since December 2006 and Chief Executive Officer since March 2007. Click here for full bio

|

Kelvin Dushnisky - Chairman

Kelvin Dushnisky served as Chief Executive Officer and a member of the Board of Directors of AngloGold Ashanti Ltd. from 2018 to 2020. Click here for full bio

|

Kevin Bullock

Kevin Bullock is a registered Professional Mining Engineer in the province of Ontario. Click here for full bio

|

|

George Johnson

George Johnson served as B2Gold’s Senior Vice President of Operations from August 2009 until April 2015 when he retired. Click here for full bio

|

Liane Kelly

Liane Kelly is a CSR professional with extensive experience in environment, social and governance (ESG) oversight. Click here for full bio

|

Jerry Korpan

Jerry Korpan has a Bachelor of Arts from the University of Alberta and a graduate degree from the University of Portland. Click here for full bio

|

|

Thabile Makgala

Thabile Makgala joined B2Gold as a director on June 23, 2023 and currently serves as the Vice President, Health, Safety, Environment, Security and Communities (HSESC) for Minerals at Rio Tinto. Click here for full bio

|

Lisa Pankratz

Lisa Pankratz joined B2Gold as a director on January 1, 2023. Ms. Pankratz has over 30 years of experience in the investment industry and capital markets in both executive and advisory capacities, working with multinational and international companies. Click here for full bio

|

Robin Weisman

Robin Weisman joined B2Gold as a continuation of her experience deeply-rooted in resource sector finance, immediately following her well-respected career at International Finance Corporation ("IFC") in Washington, D.C. as a Principal Investment Officer. Click here for full bio

|

Summary of Mineral Reserve & Mineral Resource Estimates

Mineral Reserves are reported from pit designs and underground stope designs based on Indicated Mineral Resources. Mineral Resources are reported inclusive of those Mineral Resources that have been converted to Mineral Reserves.

Economic parameters such as mining costs, processing costs, metallurgical recoveries and geotechnical considerations have been applied to determine economic viability of the Mineral Reserves based on a gold price of US$1,500 per ounce (“/oz”) (unless otherwise stated). Mineral Reserves contained in stockpiles that meet the project-specific Mineral Reserve cut-off grades are also included for the Fekola Mine, the Masbate Gold Project and the Otjikoto Mine.

Mineral Resources amenable to open pit mining are constrained with conceptual pit shells defined by economic parameters and using a gold price of US$1,800/oz. Mineral Resources amenable to underground mining methods are reported above cut-off grades defined by site operating costs and using a gold price of US$1,800/oz. Mineral Resources contained in stockpiles that meet the project-specific cut-off grades are also included for the Fekola Mine, the Masbate Gold Project and the Otjikoto Mine. Gold grades are expressed in grams per tonne of gold (“g/t Au”).

Mineral Reserve and Mineral Resource estimates for our operating mines have been updated to account for mining depletion, using topographic surfaces as of December 31, 2021. These Mineral Reserve and Mineral Resource estimates are reported by project/mine on both a 100% project basis reflecting the total Mineral Resources and Mineral Reserves and the applicable project/mine specific attributable basis reflecting our ownership interest (details in table footnotes below).

Probable Mineral Reserves Statement

| Country | Mine or Project | 100% Project Basis | Attributable Ownership Basis | |||||

| Tonnes (x 1,000) |

Gold Grade (g/t Au) |

Contained Gold Ounces (x 1,000) |

Ownership Percentage (%) |

Tonnes (x 1,000) |

Gold Grade (g/t Au) |

Contained Gold Ounces (x 1,000) |

||

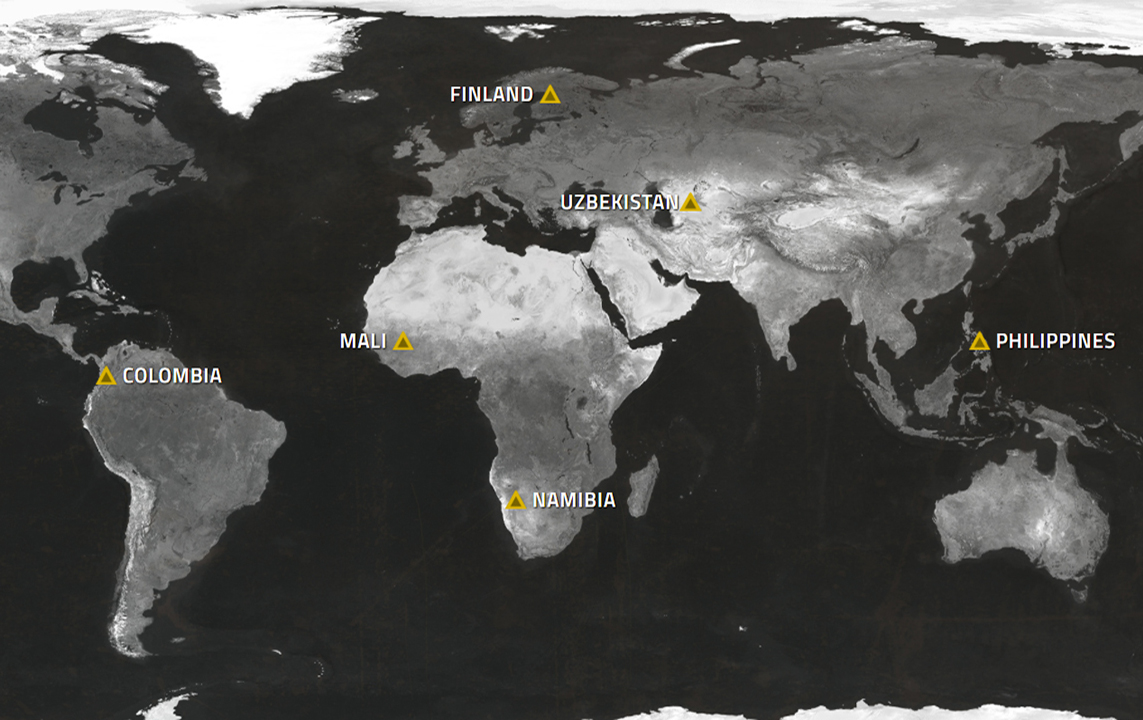

| Mali | Fekola | 62,00 | 1.86 | 3,710 | 80 | 49,600 | 1.86 | 2,960 |

| Philippines | Masbate | 73,500 | 0.80 | 1,890 | 1003 | 73,500 | 0.80 | 1,890 |

| Namibia | Otjikoto | 11,600 | 1.66 | 620 | 90 | 10,400 | 1.66 | 560 |

| Total Probable Mineral Reserves (includes stockpiles) |

6,210 | 5,410 | ||||||

Indicated Mineral Resource Statement

| Country | Mine or Project | 100% Project Basis | Attributable Ownership Basis | |||||

| Tonnes (x 1,000) |

Gold Grade (g/t Au) |

Contained Gold Ounces (x 1,000) |

Ownership Percentage (%) |

Tonnes (x 1,000) |

Gold Grade (g/t Au) |

Contained Gold Ounces (x 1,000) |

||

| Mali | Fekola |

102,800 |

1.51 | 4,980 | 80 | 82,200 | 1.51 |

3,980 |

| Anaconda Area | 32,400 | 1.08 | 1,130 | 80 and 85 | 27,100 | 1.08 | 940 | |

| Cardinal | 8,000 | 1.67 | 430 | 80 | 6,400 | 1.67 | 340 | |

| Philippines | Masbate | 126,500 | 0.78 | 3,180 | 1005 | 126,500 | 0.78 |

3,180 |

| Namibia | Otjikoto | 48,200 | 0.88 | 1,370 | 90 | 43,400 | 0.88 |

1,230 |

| Colombia | Gramalote | 173,400 | 0.73 | 4,060 | 50 | 86,700 | 0.73 |

2,030 |

| Total Indicated Mineral Resources (includes Stockpiles) |

15,140 |

11,700 |

||||||

Inferred Mineral Resource Statement

| Country | Mine or Project | 100% Project Basis | Attributable Ownership Basis | ||||||

| Tonnes (x 1,000) |

Gold Grade (g/t Au) |

Contained Gold Ounces (x 1,000) |

Ownership Percentage (%) |

Tonnes (x 1,000) |

Gold Grade (g/t Au) |

Contained Gold Ounces (x 1,000) |

|||

| Mali | Fekola | 10,100 | 1.23 | 400 | 80 | 8,100 | 1.23 | 320 | |

| Anaconda Area | 63,700 | 1.12 | 2,280 | 80 and 85 | 53,100 | 1.12 | 1,890 | ||

| Cardinal | 19,000 | 1.21 | 740 | 80 | 15,200 | 1.21 | 590 | ||

| Philippines | Masbate | 27,800 | 0.77 | 690 | 1005 | 27,800 | 0.77 | 690 | |

| Namibia | Otjikoto | 6,600 | 1.80 | 380 | 90 | 6,000 | 1.80 | 340 | |

| Colombia | Gramalote | 58,200 | 0.59 | 1,100 | 50 | 29,100 | 0.59 | 550 | |

| Total Inferred Mineral Resources | 5,590 | 4,390 | |||||||